Where Does Bad Data Come From?

By Ron Branchaud, Muhammad Adil, Mobolaji Salawu, and Markle Atienza

The Hidden Cost of Poor Data in Oil & Gas: How Asset Traceability Breaks and How to Fix It

One missing certificate, one inconsistent stencil — and an entire pipeline section can be riddled with unnecessary delays or reviews in today’s regulatory climate. In oil and gas, asset data is not an admin detail; it is the connective tissue that links procurement, inspection, maintenance, and compliance. When that data chain breaks, the costs can be profound: project delays, urgent re-testing, regulatory exposure, and wasted manpower.

Let’s explore what good asset data looks like, how it fractures in the real world, and what practical steps can be taken to preserve traceability, including a pragmatic, low-friction path forward for getting traceable, audit-ready asset records.

What Is Asset Data Integrity — and Why Does It Matter?

Asset data integrity is the assurance that every record associated with a physical asset is trustworthy, complete, consistent, and accessible. This includes information about identification (serial numbers, asset tags, model numbers), location (GPS coordinates, facility zones, installation points), operational history (maintenance records, usage logs), and so on.

When this asset data is well-managed and reliable, organizations can:

Prove material provenance in audits

Avoid construction and installation delays

Speed up procurement and commissioning

Plan preventive maintenance with confidence

Reduce unplanned downtime

Mitigate compliance risk

What Does Bad Data Look Like?

Bad data shows up long before it causes big problems. It can slip into the asset lifespan at any point—from design and engineering handovers to supplier submissions, construction records, inspections, and ongoing maintenance updates. And once it’s in, it spreads. The most common failure patterns are outlined in Table 1.0 and illustrate how quickly small data gaps can escalate into operational risk.

Table 1.0: Common Data Quality Failure Modes

| Data Issue | Example / Description | Potential Implication |

|---|---|---|

| Missing asset attributes | Key fields like serial numbers or install dates are blank | Difficult to prove what is on site |

| Missing asset documentation | Missing material certificates, inspection records, or maintenance logs | Regulators may require re-testing or quarantining |

| Inconsistent identifiers across systems | Same pump recorded as “PMP-001” in one system and “Pump-A1” in another | Fractured lifespan history |

| Incorrect entries | Wrong heat number or specifications | Wrong materials may be installed; regulators may flag non-conformance |

| Duplicate records | Same asset ID appears multiple times where unique identification is required | Confusion in procurement and inventory management |

The Cost of Broken Asset Traceability

When asset traceability breaks down, ripple effects are significant. This cost is exemplified using these scenarios below:

Scenario 1: When Traceability Gaps Impede Operations

Consider a pipeline operator facing a routine regulatory audit. Inspectors request documentation to confirm the origin and certification of several replacement valves installed five years earlier. The operations team assumes the records are in order - until they realize the mill certificates for two valve assemblies are missing.

The valve assemblies themselves are operationally sound, but without traceable documentation, the company cannot prove compliance. In this scenario, the regulator could explore multiple avenues including a reduction in line pressure or – in extreme cases – a temporary shut-in, triggering millions in lost revenue and avoidable inspections.

Lesson: The issue here is not faulty equipment - it’s missing asset documentation. A single gap in traceability can create a chain reaction of cost, delay, and reputational damage.

Scenario 2: When Naming Inconsistencies Break Traceability

On a large offshore project, multiple contractors were responsible for supplying and installing equipment. One contractor labeled a critical pump as “PMP-001” in the engineering system, while another referred to the same asset as “Pump-A1” in commissioning records. Later, the maintenance team logged inspection results under yet another variation of the name.

Individually, each team thought they were working correctly. But when an audit required pulling the full lifespan history of that pump - from procurement through commissioning to maintenance - the records didn’t line up. The asset appeared as three different pumps across three systems, with no clear way to reconcile the data.

Lesson: The equipment itself was never the issue - the pump worked as designed. The real problem was data fragmentation caused by inconsistent data format. Without a unified standard, the digital thread of the asset broke, leaving the company unable to demonstrate full traceability when it mattered most.

Rethinking Asset Data: From Burden to Advantage

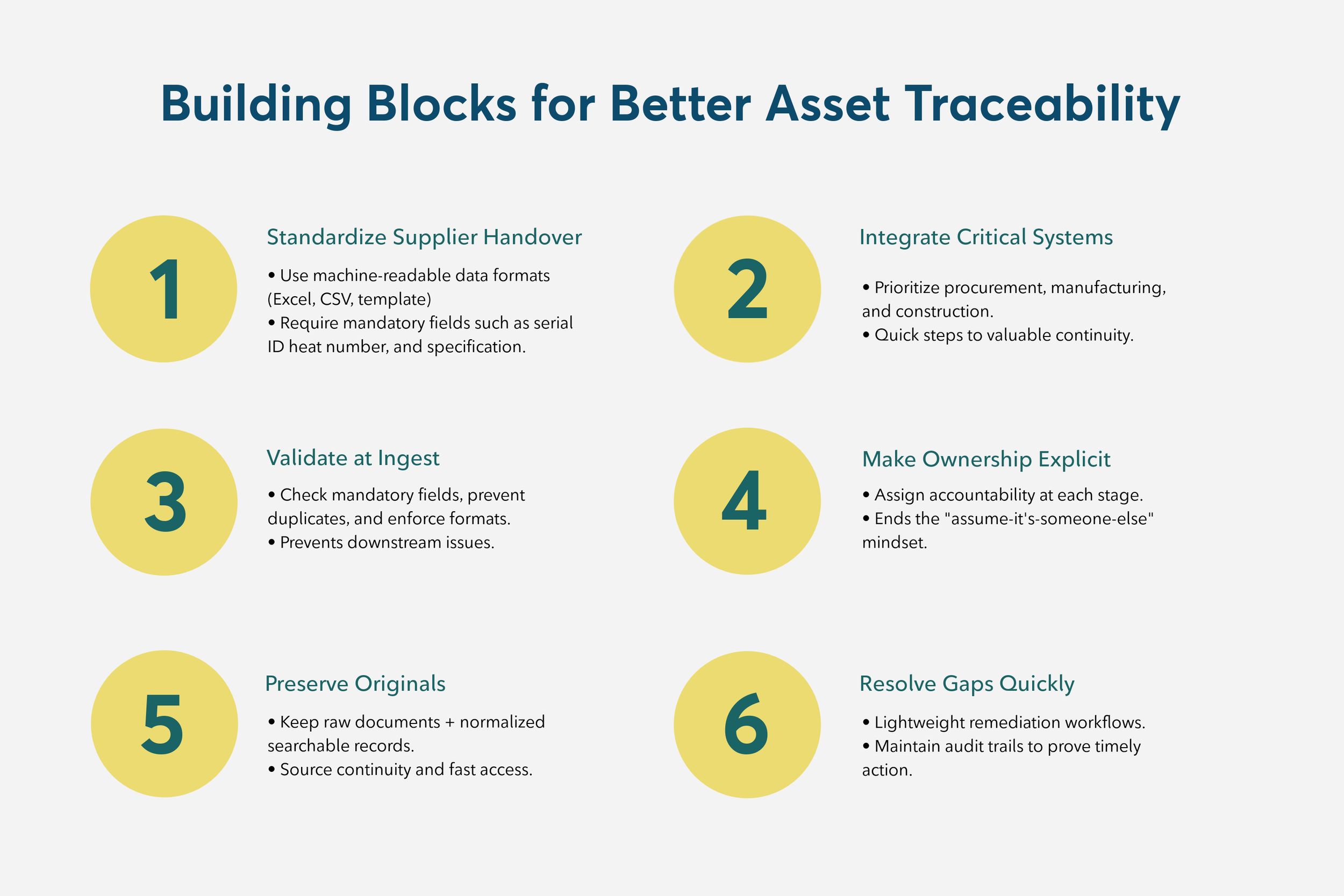

The good news is, poor-quality data is not inevitable. Also, ensuring asset traceability does not require a costly all-or-nothing overhaul. By tackling the right steps in the right order, organizations can turn asset data from a daily frustration into a strategic advantage.

Standardize supplier handover: Require machine-readable delivery of data where possible (Excel, CSV or standardized templates) with mandatory fields, for example - serial identification, heat number, specification, supplier contact, and so on. Make these requirements part of procurement / EPC contracts.

Prioritize integrations that reduce audit pain: Connect the systems that can cause the most friction first. This typically includes procurement, manufacturing and logistics, and construction. You do not need full enterprise integration to get valuable continuity.

Validate at ingest: Apply checks when new asset records are accepted: required fields present, no duplicates, format validation (e.g., primary identifier patterns). Flag issues before they enter the system.

Assign clear data ownership: Name the person or team accountable for data completeness at each lifespan stage. Accountability ends the “assume-it’s-someone-else” problem.

Preserve originals plus create a normalized record: Keep raw supplier documents (mill certs, drawings) and a normalized, indexed record that references those originals. That gives you both source continuity and quick searchable access.

Low-friction remediation workflows

Create lightweight workflows for remediating missing documents (request supplier reissue, record test results, attach scanned originals), with audit trails to prove timely action.

A Practical Path Forward

Asset traceability is foundational to safety, regulatory assurance, and efficient capital execution. When it breaks—whether due to inconsistent identifiers, missing certificates, or incomplete records—the impact goes far beyond administrative headaches. These gaps introduce real operational risk, slow decision-making, and can trigger costly delays when verification is required.

The good news: fixing this doesn’t demand a full-scale overhaul. Organizations can make meaningful progress with a pragmatic, scalable approach rather than a complete rip-and-replace. Combining expert data curation with a purpose-built platform delivers the best of both worlds. Specialists can audit, clean, and standardize supplier records to create a Verified Single Source of Truth, while a configurable platform preserves original documents, enforces conformance rules, and provides field teams with trusted, traceable asset data (including offline access). The result is less audit friction, fewer surprises, and renewed confidence in the data that keeps people and assets safe.

Want a practical starting point? Book a 30-minute vintriCORE demo to see how supplier data becomes traceable, auditable, and ready for your systems of record.